ev tax credit bill point of sale

Used EV prices are no longer on the way up according to new data but just 12 of the used-EV inventory might be eligible for a new tax credit on used EVs under 25000. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23.

Inflation Reduction Act Seeks To Jumpstart Electric Vehicle Market Insights Dla Piper Global Law Firm

Below we will examine an actual electric.

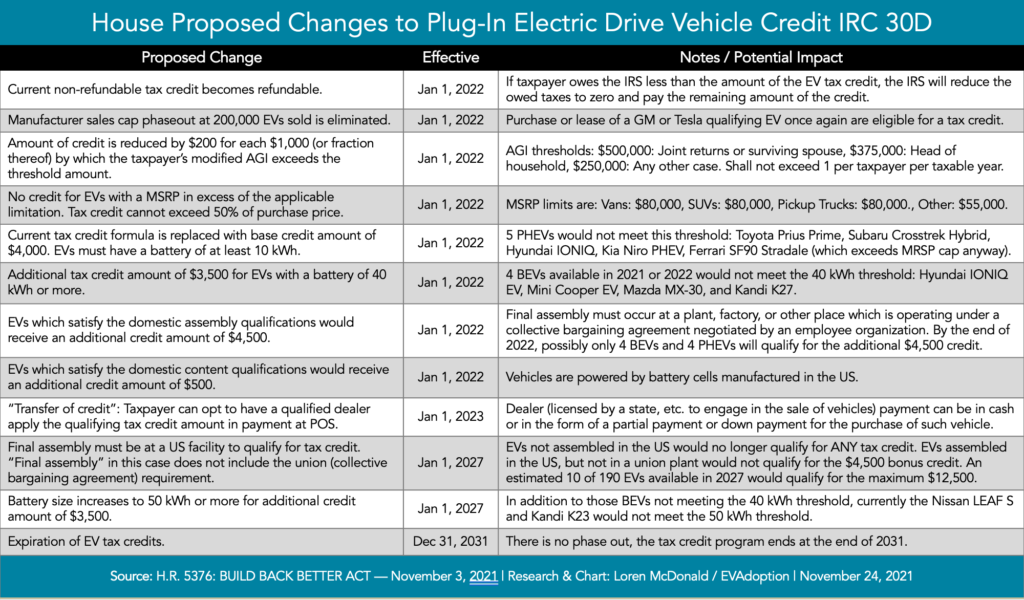

. Moreover knowing how to read your elec-tric bill is a good way to check for errors and can help you monitor your exact energy usage. The language in the bill indicates that the tax credit would be implemented at the point of sale instead of on taxes. Add an additional 4500 for EV assembled at.

Sedans more expensive than 55000 and SUVs and Trucks more expensive than 80000 are not eligible for the credit. The version of the EV tax credit that passed the senate committee a month ago wasnt a point-of-sale rebate it was still just a tax. Thats why we have a dedicated customer service phone line just for you.

Individuals who make up to 150000 annually would be eligible for the. The Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000. In the future the US.

As a New Jersey resident you are entitled to a free copy of your credit report once a year from each of the major credit agencies. The tax credit can now be applied at the point of sale. The full EV tax credit will be available to individuals.

Edmunds has 580 new Chevrolet Bolt EUVs for sale near you including a 2023 Bolt EUV LT Hatchback and a 2022 Bolt EUV Premier Hatchback ranging in price from 29155 to 43995. Since the US added EV tax. That number will gradually grow to 100 in 2029.

US congressional leaders have agreed to a bill that would expand the existing 7500 new EV tax credit while introducing the first federal tax credit for used EVs. You have the right to a free copy of your credit information. Electric trucks vans and SUVs would have an 80000 cap and cars would be capped at 55000.

A used EV tax credit begins January 1 with the lesser of 30 of the selling price or 4000 available for used EVs purchased from a dealer and costing less than 25000. Its called the Inflation Reduction Act and among a long list of new legislation backed by 374 billion in climate and energy spending it includes an updated 7500 electric. One of the major parts of the bill is new tax credits for electric vehicles.

The EV tax credit can make an electric car more affordable but there are pros cons worth knowing about before buying or leasing an electric car. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. That cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not qualify for the electric car tax credit until next year.

Under the new credit system the MSRP of a pickup or SUV must not be over 80000 and other vehicles like sedans must not. If youre one of our business customers we know that you sometimes have very specific needs. Psst the number is.

Electric Vehicle Credits Just Completely Changed Here S What It Means For Car Buyers Cnn Business

Potential Us Ev Tax Credit May Break World Trade Organization Rules

Yes You Can Still Get Electric Vehicle Tax Credits Here S A Guide Marketwatch

Ev Tax Credits On The Table As Democrats Try Reviving Parts Of Build Back Better The Hill

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

Will Inflation Reduction Act Give Tax Credit For Electric Vehicles Deseret News

Should Congress Lift The 200 000 Sales Ev Tax Credit Cap Cleantechnica

Ev Tax Credit Extension With 7 500 Point Of Sale Rebate 4 000 For Used Evs Could Pass Senate Soon

Ev Tax Credits Are Not Retroactive Here S Why Youtube

Revamping The Federal Ev Tax Credit Could Help Average Car Buyers Combat Record Gasoline Prices International Council On Clean Transportation

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Proposed Federal Ev Tax Credit Reform Will It Move The Sales Needle Evadoption

Why The New Ev Tax Credit Would Be A Game Changer For Electric Cars Grist

The New Electric Vehicle Tax Credit Everything You Need To Know

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post

.jpg)